How we can help?

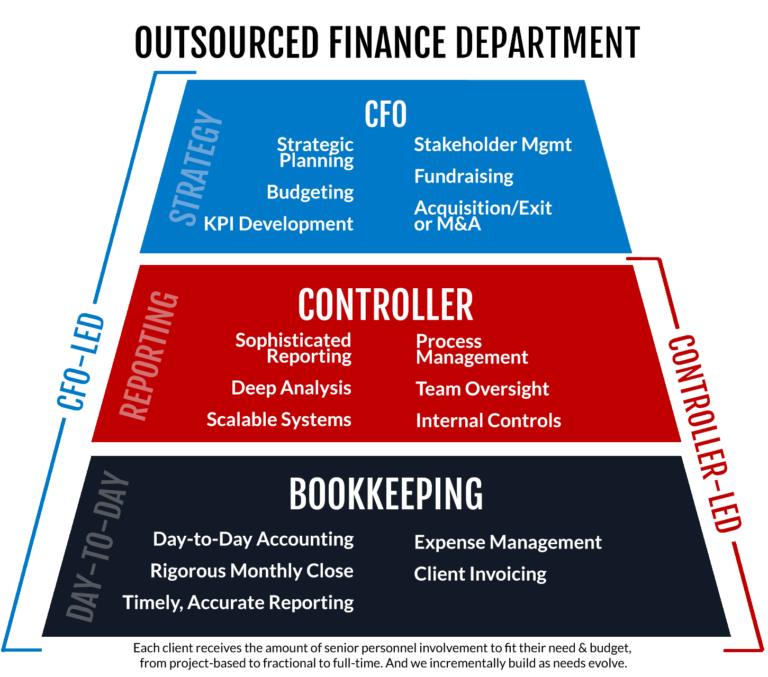

Accounting & Financial Outsourcing

Whether you’re ready to improve an existing financial report or if you’re lacking a competent, reliable accountant– we can help. Our services are designed to save time and money by outsourcing the financial department of your organization rather than employing full-time employees in your office. As a client, you will find our specialists trained to quickly spot opportunities for growth or identify problem areas where you may be bleeding profits. You will find that with our leadership and experience, you can grow faster and make more money for everyone involved!

Fractional Operational Services

1) Change Management: Effectively managing change processes while minimizing disruptions to ongoing operations.

2) Process Analysis & Improvement: Identifying opportunities to enhance efficiency and reduce costs by implementing improved processes, systems, and solutions.

3) Risk & Compliance Management: Ensuring compliance with

legal requirements, mitigating risks, and managing regulatory obligations across various functions.

4) Business Systemization: Implementing controls and systems that allow company owners to delegate day-to-day business administration and focus on strategic aspects.

5) Operational Metrics: Establishing and tracking key metrics and performance indicators to optimize financial performance and enhance cash flow.6) Workforce Planning: Working closely with HR operations to

support effective people-management policies and procedures, aligning workforce planning with overall business objectives.

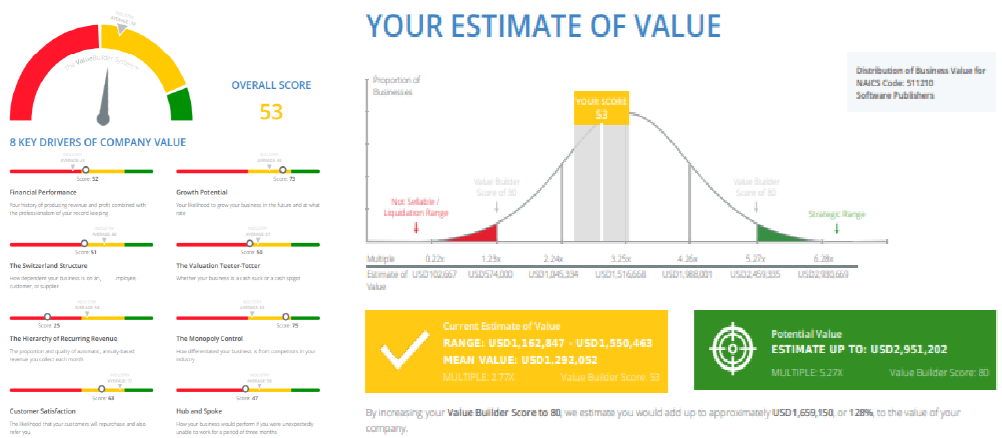

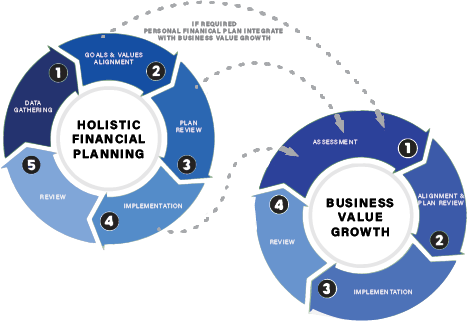

Company Value Growth Acceleration

Whether you’re ready to improve an existing financial report or if you’re lacking a competent, reliable accountant– we can help. Our services are designed to save time and money by outsourcing the financial department of your organization rather than employing full-time employees in your office. As a client, you will find our specialists trained to quickly spot opportunities for growth or identify problem areas where you may be bleeding profits. You will find that with our leadership and experience, you can grow faster and make more money for everyone involved!

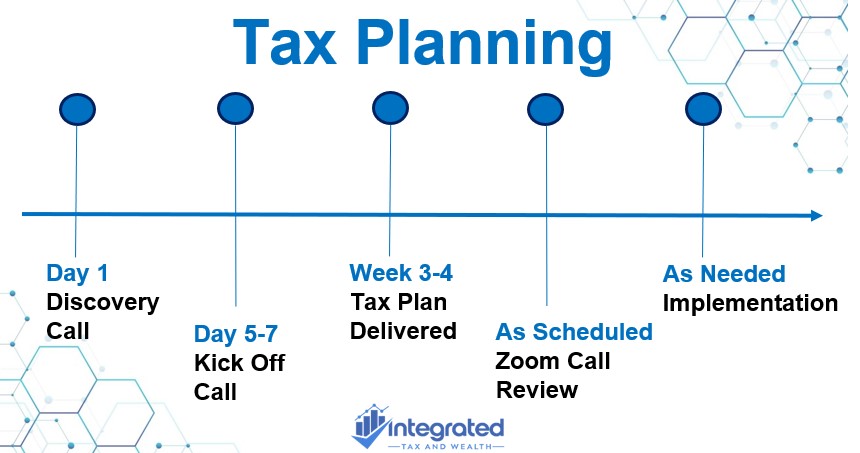

Tax Planning

Taxes represent one of the largest annual expenses for business and individuals in the United States. While often just accepted, a do-nothing approach to tax planning causes taxpayers to lose thousands of their hard-earned dollars every year. Our tax planning focuses on identifying the right combination of tax saving strategies for your situation.

Integrated Tax & Wealth Planning

Customized tax minimization strategies are designed to be integrated with your wealth building plan.

Out approach is to be your guide in the development of your wealth creation plan. We want you to know how to create and manage your own plan so you can limit your advisory expenses. You will be using professional advisor software, investment banking models and financial independent systems.

CFO Services

- Financial, business, and strategic planning and implementation.

- Management of the finance infrastructure (accounting, treasury, tax, finance)

- Cash flow management and projections.

- Budgeting and forecasting.

- Hands-on transition guidance (e.g., medical leave, business integration, or leadership succession)

Tax Resolution

We provide affordable solutions for business and individuals who for whatever reason find themselves at odds with the IRS. We will represent you in front of the IRS allowing you to continue to with your life. You will NOT have to talk to an IRS agent.

How we can help?

Integrated Tax & Wealth Planning

Customized tax minimization strategies are designed to be integrated with your wealth building plan.

Out approach is to be your guide in the development of your wealth creation plan. We want you to know how to create and manage your own plan so you can limit your advisory expenses. You will be using professional advisor software, investment banking models and financial independent systems.

Integrated Tax & Wealth Planning

Customized tax minimization strategies are designed to be integrated with your wealth building plan.

Out approach is to be your guide in the development of your wealth creation plan. We want you to know how to create and manage your own plan so you can limit your advisory expenses. You will be using professional advisor software, investment banking models and financial independent systems.

CFO Services

- Financial, business, and strategic planning and implementation.

- Management of the finance infrastructure (accounting, treasury, tax, finance)

- Cash flow management and projections.

- Budgeting and forecasting.

- Hands-on transition guidance (e.g., medical leave, business integration, or leadership succession)

Tax Resolution

We provide affordable solutions for business and individuals who for whatever reason find themselves at odds with the IRS. We will represent you in front of the IRS allowing you to continue to with your life. You will NOT have to talk to an IRS agent.

Our 6-D Tax Planning Process

01

Discover

Working together we will conduct a fact find to understand your current situation. We will clearly define your professional and personal goals.

02

Design

Here we evaluate all our the tax strategies that could provide tax savings to initially design your plan.

03

Develop

Development will further refine you plan to identify the key strategies based on tax savings / return compared to cost.

04

Deliver

We will deliver a complete documented tax plan. Your plan will include the top strategies to implement immediately and additional strategies for further future savings.

05

Deploy

We include a list of action items to deploy the top strategies. At your discretion we can help with the deployment.

06

Determine

Finally within a year we will meet again to determine if there any tax law changes and / or additional tax strategies you can implement for further savings.